Our nation-wide recession has hit each community to a different degree, but

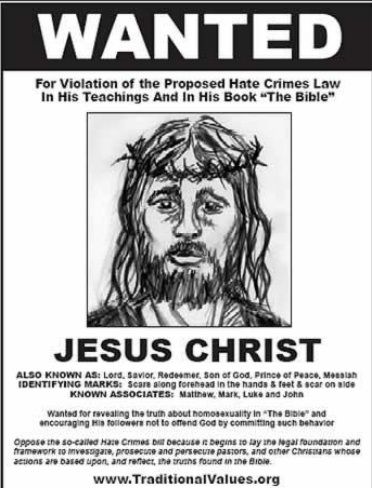

As the second article details, there are over 100 “right-wing Christian organizations” in

This recession has thrust into the forefront an issue few people really even know about—tax exemption for religious organizations. All non-profit organizations are permitted to receive tax-exempt status from the government, so they do not have to pay federal income tax and, on a state-by-state basis, can be exempt from sales tax, property tax, and local income taxes. Most religious organizations, as long as they do not involve themselves in political elections, are non-profit organizations and thus granted this tax-exempt status.

This is not simply the government excluding charitable donations and the like from being subject to taxes—a church’s soup kitchen is exempt, but so is a fun pizza party for its members. There is a strong argument for religious organizations’ continued existence as tax-exempt entities—they are non-profit organizations, generally dedicated to improving the spiritual well-being of their members and helping the local community. Our government recognizes the usefulness of all types of non-profits, and this tax exemption can be viewed as either removing the burden of paying taxes from all of these groups, or favoring these groups, including religious organizations, over the rest of the population.

It was hard to discern my own opinion on the subject, but I think that in the end I have to come down on the side of the religious organizations. As long as these entities are following the government’s rules for non-profit organizations, they deserve to have the state’s burden of taxes lifted when other organizations with a secular purpose are treated in that way. This also helps to avoid a perception of an establishment of religion, since secular and religious organizations are held to the same standards for tax exemption. I think that as long as any type of organization meeting the guidelines for a non-profit organization is granted tax-exempt status, without regard to its religious affiliation, the exemption is constitutional. And in fact, granting tax exemption to secular non-profits and not religious ones is really an unfair burden on religion and probably unconstitutional itself.

However, in this case