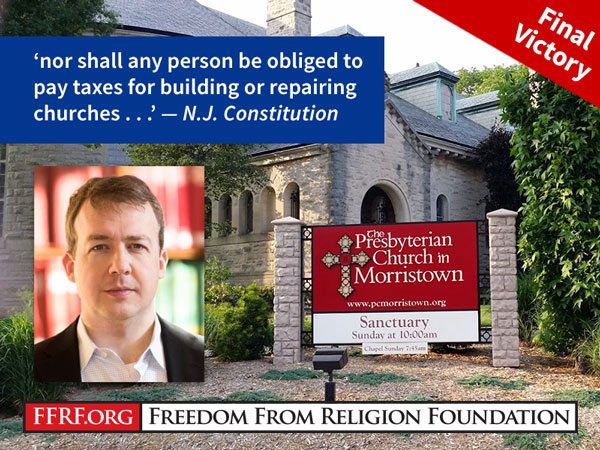

In 2015, The Freedom From Religion Foundation (FFRF)

filed suit against Morris County challenging public grants of tax dollars to

repair or maintain churches. The Historic Preservation Trust Fund is a publicly

funded trust that gives money to places of historical significance in order to address

preservation needs of the property. 55% of the fund, or over 4.6 million

dollars, went to 12 churches in the northern New Jersey area. The money was

used to fix facades, stain-glassed windows and aging roofs. New Jersey State Constitution

states: “nor shall any person be obliged to pay tithes, taxes, or other rates for

building or repairing any church or churches, place or places of worship, or

for the maintenance of any minister or ministry, contrary to what he believes

to be right.” The Superior Court of New Jersey ruled in 2017 that contending

the controlling case involved educational grants rather than historic

preservation grants. This ruling was in Morris County’s favor and made it so

that the grants going to the churches was constitutional. Immediately following

this ruling, the FFRA appealed the case to the New Jersey Supreme Court. The

New Jersey Supreme Court accepted the case on direct appeal and in 2018 they

ruled in favor of the FFRA. They stated: “We find that the plain language of

the Religious Aid Clause bars the use of taxpayer funds to repair and restore

churches, and that Morris County’s program ran afoul of that longstanding

provision…” The court also ruled that the clause in the State Constitutional

did not run afoul of the Free Exercise clause in the federal Constitution. Upon

this ruling, Morris County submitted an appeal to the United States Supreme

Court.

In 2015, The Freedom From Religion Foundation (FFRF)

filed suit against Morris County challenging public grants of tax dollars to

repair or maintain churches. The Historic Preservation Trust Fund is a publicly

funded trust that gives money to places of historical significance in order to address

preservation needs of the property. 55% of the fund, or over 4.6 million

dollars, went to 12 churches in the northern New Jersey area. The money was

used to fix facades, stain-glassed windows and aging roofs. New Jersey State Constitution

states: “nor shall any person be obliged to pay tithes, taxes, or other rates for

building or repairing any church or churches, place or places of worship, or

for the maintenance of any minister or ministry, contrary to what he believes

to be right.” The Superior Court of New Jersey ruled in 2017 that contending

the controlling case involved educational grants rather than historic

preservation grants. This ruling was in Morris County’s favor and made it so

that the grants going to the churches was constitutional. Immediately following

this ruling, the FFRA appealed the case to the New Jersey Supreme Court. The

New Jersey Supreme Court accepted the case on direct appeal and in 2018 they

ruled in favor of the FFRA. They stated: “We find that the plain language of

the Religious Aid Clause bars the use of taxpayer funds to repair and restore

churches, and that Morris County’s program ran afoul of that longstanding

provision…” The court also ruled that the clause in the State Constitutional

did not run afoul of the Free Exercise clause in the federal Constitution. Upon

this ruling, Morris County submitted an appeal to the United States Supreme

Court.However, in 2019, the Supreme Courtdecided to not hear the case. Its brief order gave no reasons for turning down appeals from a country board and a church. Newly appointed justice, Justice Kavanaugh, agreed with the Court’s decision to not hear the case but gave a caveat: “the decision of the New Jersey Supreme Court is in serious tension with this court’s religious equality precedents.” Justice Alito and Justice Gorsuch joined in Justice Kavanaugh’s opinion. Some of the justices that reside on the Supreme Court seem uneasy at the New Jersey Court’s decision. This is the tension left over from the 2017 ruling of Trinity Lutheran Church v. Comer. The Supreme Court ruled that Missouri could not exclude religious institutions from a state program to make playgrounds safer even though the state’s Constitution called for strict separation of church and state. Recalling Morris County v. FFRA up to the Supreme Court would allow some of the justices to clarify and justify their reasoning in Trinity Lutheran Church v. Comer. Justice Kavanaugh wrote “In this case, New Jersey’s ‘No religious organizations need apply’ for historic preservation grants appears similar to, for example, Missouri’s ‘No religious schools need apply’ for school playground grants,” when comparing the two cases. Justice Kavanaugh also stated that “At some point, this court will need to decide whether governments that distribute historic preservation funds may deny funds to religious organizations just because they are religious.”

This issue has been raised many times before us. That is, does allowing churches to receive public funding impede on the Establishment Clause of the Constitution? In Lemon v. Kurtzman, a Pennsylvania statute reimbursing religious schools with state funds for textbooks and teacher salaries was struct down. The reasoning behind this decision was that the law garnered an excessive entanglement of religion and state, and, therefore, violated the Establishment Clause. In Locke v. Davey, the Court decided that the state of Washington’s decision to withhold academic scholarship funds from students pursuing devotional divinity degrees was constitutional. Washington simply chose not to fund a particular category of instruction rather than imposing sanctions on any type of religious beliefs or forcing a student to choose between religion and receiving a government benefit. These two cases involve the same base: public/tax funding to benefit religion. Using these cases as precedents, it would seem that the court would rule that allowing churches to receive public funding for preservation does impede on the Establishment Clause of the Constitution.

In my opinion, I agree that churches taking public funding for preservation establishes religion which is a violation of the Constitution. This is funding that directly benefits several churches. Government directly benefitting religion has not held up in court very often. We have seen that indirect aid can be acceptable depending on the circumstances, but direct aid has been strictly forbidden. Around four million dollars was used that the churches would have otherwise had to raise themselves. This is a lot of money that some taxpayers would rather have going elsewhere. How do the taxpayers know if their money was used so that the churches could buy new flat-screen televisions so that the church could “preserve” itself? I think this case could provide us with a slippery slope if ruled otherwise. I also want to address Justice Kavanaugh’s concerns. The main problem that Kavanaugh had with Morris County v. FFRF is that it was similar to Trinity Lutheran Church v. Comer but the cases were ruled differently. In the Trinity Lutheran case, government funds went to maintaining playgrounds on church property, while in the Morris County case, public funds were denied to go to churches in the name of preservation. I think these cases are extremely distinct. Playgrounds have a secular purpose and have safety and health concerns geared towards children if not maintained well. This can be seen as indirect aid to the church because it was on church property, but it benefits the public more because mostly children in the area use the playground. Giving taxpayer funds directly to the church is direct funding. Different cases have different details and, therefore, have different rulings. The ruling of the Trinity Lutheran Church case was extremely narrow due to the details.

1 comment:

I agree very much so with TJ. I do not see how, especially considering the NJ law concerning state funding of churches, these taxpayer funds could be used in this way. While there could certainly be historic significance in matters such as these, there is not enough compelling evidence to allow for this to be an exemption of the separation law. To allow for funds to be used like this would be a clear breach in the first amendment and would constitute a direct governmental aid to religious organization.

Post a Comment